Back in March I wrote that the U.S. commercial vehicle

market was signaling that a recession would begin sometime between July and

November of this year. The commercial

vehicle market is usually a superb leading economic indicator because changes

in freight growth first show up in how much new equipment is needed to haul

these goods.

But here it is November, and the current economic data indicates

an upturn, not a downturn, in the economy.

Why isn’t the commercial vehicle market a reliable indicator this time?

I’m not sure, but it’s certainly not alone.

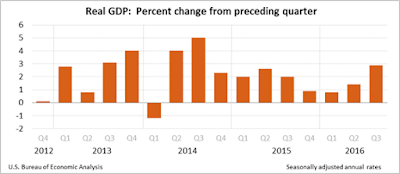

I realized this as I studied a chart on year-over-year

change in employment growth (total employment by month) published by

calculatedriskblog.com. It makes sense

than when increases in employment start to slow, then the economy will stop

growing at some point. The concept is

similar to commercial vehicles, less total trucks needed to haul diminishing

freight, less total employees needed to do diminishing work. It has been a fairly reliable predictor of

past recessions, but not this time.

More enlightening is to review (Google) the headlines

predicting recession this year:

February – Recession – It’s Already Started

March – Economy Already In Recession

May – It’s Undeniable – The Recession Is Already Here

June – The Next Recession Is Already Here

August – This Graph Says It All – The Recession Is Here

August – Historical Data Will Show That U.S. Was In

Recession

September – U.S. May Now Be In A Recession

September – The U.S. Economy Is In A Recession

September – The U.S. Economy Is Coming Out Of Recession.

November – We Are Currently In Recession (This one was an

analyst on a cable business program)

All of these analyses were based on current graphs,

indices, models, and whatever, and certainly based on past trends. And according to current GDP data, these predictions

are:

Wrong

Wrong

Wrong – deniable

Wrong

Wrong – probably

Wrong – bad graph

Wrong - probably

Interesting, since we officially weren’t in recession

And probably wrong, but it’s too early to tell.

So, predicting a recession is difficult, even more difficult

than picking the winner of a big election. Forecasting a recession under the current

economic conditions is nearly impossible, and any analyst who correctly

predicts the next one is probably more lucky than good. Some traditional economic indicators remain

broken, inconsistent, and in many cases, unusable. These remain abnormal economic times.

But still, it is odd for all these economist and analysts

(and the commercial vehicle markets) to all be wrong. Could something else be happening here? Perhaps under these highly stimulated, highly

controlled, not yet fully recovered from the Great Recession conditions, this

is what an economic downturn looks like.

You can’t call it a recession, because GDP is not negative for two

quarters, but it is an “extended low growth dip.” That doesn’t roll off the tongue, maybe try

ELGD. It’s not difficult to spot it on

the graph:

Did regulation and controls prevent the economy from going

into recession? Well, communist

economies don’t go into recession very often because of the strict government

controls, so yes comrades, this may be the answer. That would indicate the largest free-market

economy is struggling to achieve 2% growth while the largest communist economy

is running up consecutive growth scores of 7.6%, 7.6%, and, yes, 7.6%. (Note to the Chinese government: It looks

very suspicious to repeat the same GDP % three times in a row. It looks like your economist took a long

vacation or that you are just making the numbers up. If one of my analyses came up the same number

three times in a row, I would employ the technique made famous by the noted

economist Reginald Fudgit and round one of the numbers up and another one

down.)

Therefore, maybe we had a recession and everyone missed

it! If so, we are out of it now, because

Q3 GDP is currently estimated to be 2.9%.

Suddenly the guy who said the recession, or maybe now the ELGD, ended in

September doesn’t sound so wacky now, does he?

Whoo Hooo! We just had a recession so mild that no one even

noticed it! There were no mass layoffs, employment even increased, and the

stock market didn’t tank! On the other hand, there will be no great snapback to

high growth, because there is nothing to snap back to. The economy is expected

to float back to around the 2% growth level. Oh boy!

The bottom line is, this economy is so docile that we can’t

even have a decent recession. There is

not enough air in the economy to produce a bubble worthy of being burst. However, about half of Americans just

indicated they were not satisfied with the status quo. Soon there will be a new economic sheriff in

town. I heard he has some business experience, so we will see what happens next.

This post first appeared on the FTR website. FTR is the leader in analyzing and forecasting the commercial transportation industry. For more information on FTR reports and services, please click here.)